Singapore is well-known for its business-friendly stance, and has many schemes dedicated to supporting business startups. This is encouraging for budding entrepreneurs, as there are many avenues to raise the working capital required to start your own business.

If you are a budding entrepreneur who has dreams of starting your own enterprise, this article will help you understand how you can get a loan for a business startup in Singapore.

What is a business startup loan?

A loan for business startups in Singapore is only available for small and medium enterprises (SMEs) and local startups who need funds for their daily operational expenses, expansion plans, or other business-related purposes.

Business loans are pretty similar to personal loans. However, instead of your personal income and credit history, the loan is made based on the financial status of your business, as well as the perceived potential to succeed – which is important in determining your ability to pay the loan back.

Most business loans have a loan tenure of between 1 to 5 years, although you may be able to negotiate for a longer repayment period with your financer.

Here are some common business loans you may consider:

What are the requirements of a business startup loan?

| Eligibility | – Business incorporated in Singapore

– At least 30% of local shareholding – Meet the minimum operational period (between 6 months to 3 years) – Minimum annual turnover may be required |

| Documents required | – Accounting and Corporate Regulatory Authority (ACRA) report

– Details of all listed directors of the business, including NRIC, recent personal income tax assessments, and all assets owned – Past financial statements and tax assessments – Company’s bank statements – Recent business contracts obtained, if any – Business and marketing plan |

Included in the table above are the general requirements when applying for business loans.

Note that these may vary according to the specific type of business loan or financing scheme you are applying for. For example, SME working capital loans may have different requirements from business credit lines.

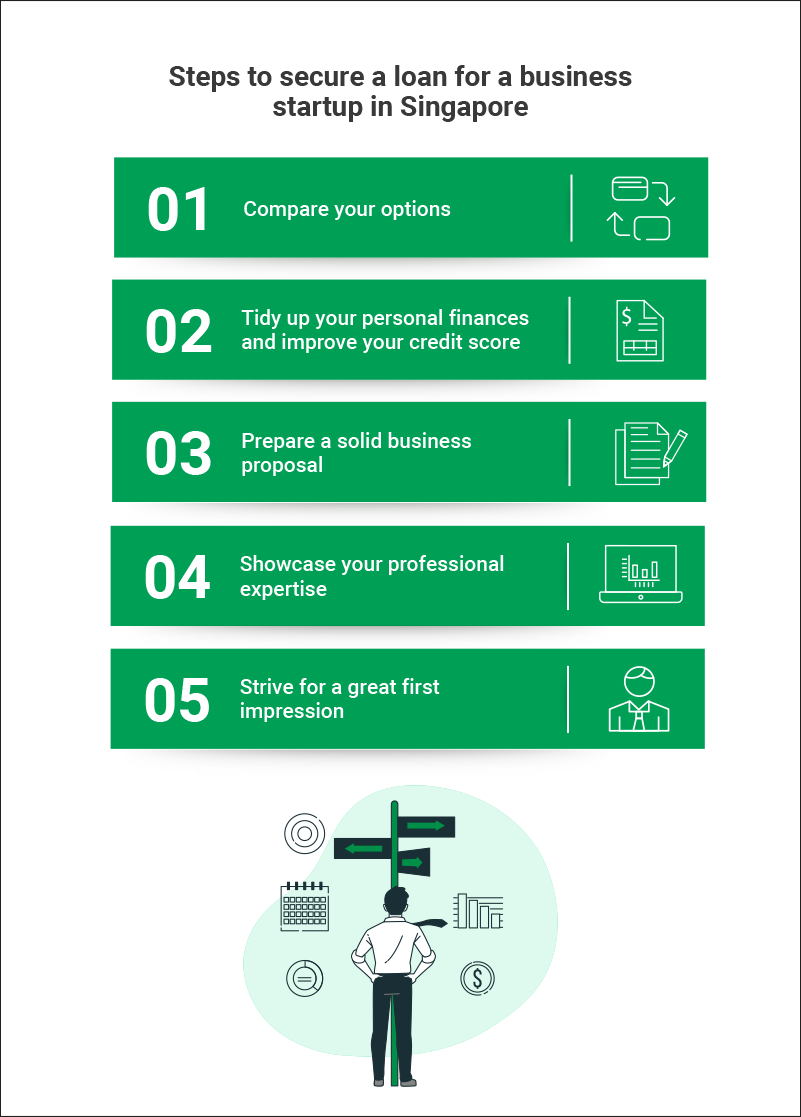

Follow these steps to secure a loan for a business startup in Singapore

1. Compare your options

Between SME working capital loans, temporary bridging loans, business credit lines, and microfinance loans, there are several options available for those seeking to find their business startups.

As such, it is a good idea to compare several options to find the best fit for your business and needs.

Some things to consider include how much you can borrow, for how long, and the interest rate offered.

2. Tidy up your personal finances and improve your credit score

The ability to manage your personal finances reflects your ability to manage your company finances. Lenders such as banks and financial institutions will look into your personal credit history when evaluating your suitability as a borrower and the likelihood of repaying your loan on time.

The same goes for your business; a history of missed bills and late loan payments will affect your chances of getting a business loan.

Before applying for any business loans, obtain a copy of your credit report to identify and fix any issues. You can improve a poor credit score by consistently meeting your financial obligations over a period of time.

3. Prepare a solid business proposal

Have a good business plan with detailed strategies, business goals, objectives, ideas, and methodologies.

A good plan should include your company’s executive summary, market analysis, marketing methods, organisation chart, financial projections, and management profile.

It’s crucial to illustrate how you plan to utilise the loan to generate profits for your business. This will boost the lender’s confidence in your ability to repay.

4. Showcase your professional expertise

Conveying that your business is in good hands and has the potential to grow will help lenders feel more confident in granting the loan.

This is where you should showcase your working experience, qualifications, and professional achievements, and how your skills and knowledge relate to your business. You can do so by attaching a detailed and concise resume to your loan application.

5. Strive for a great first impression

Should you be invited to meet the lender for your loan application, be sure to strive for a great first impression.

Dress smartly and professionally, speak confidently and clearly, and be prepared to answer any questions about your business plans that your lender may have.

Additionally, consider the meeting an opportunity to build a relationship with your lender, and take the opportunity to clarify any queries of your own. Choose the right business loan for you

At the end of the day, taking out a loan to acquire sufficient funds to start a business is simple as long as you follow the right steps. Here’s a quick recap of the process we’ve gone through above:

Hopefully, this article has given you an understanding of how you can obtain a loan for a business startup in Singapore.

While schemes such as SME working capital loans, and microfinance loans are popular, they come with strict eligibility criteria that young or untested businesses may not qualify for.

Another barrier you may encounter is the long waiting time; banks and certain financial institutions can take six to eight weeks to approve your business loan application.

If this is the situation you are facing, know that an authorised money lender can also provide the business startup loan you need.

At Elite Investment & Credit, we understand the growing needs of small businesses and provide competitive SME working capital loans with a process that’s simple, fuss-free, and speedy.

About the Author

Jasbir Kaur

No fuss, No stress. You can count on me to get the facts right.