Licensed Moneylender & Loan Company in Singapore for Legal Monthly Loans

Competitive

Interest Rates

Fast

Money Lender Loan Processing

Professional

Customer-Centric Service

Established Expertise

10+ Years in Money Lending

Elite is a local legal money lender assisting all financial needs

Elite is a

local legal money lender

assisting all financial needs

We’re a Licensed Money Lender Founded in 2010

Elite Investment & Credit is armed with over a decade of experience as a premier licensed money lender in Singapore. Professional service is in our loan company’s DNA.

We’re a Legal Loan Company in Singapore

We are a Geylang money lender that’s conveniently located near an MRT station. Apply for your money lender loan with ease.

We Adopt an Empathetic Approach

As a top legal lender in Singapore, we distinguish ourselves from other licensed money lenders by actively engaging with our customers and attentively understanding their financial concerns.

We Provide Personalised Solutions for Money Lender Loans

As a licensed money lender who takes the time to comprehend our customers’ financial worries, we’re able to provide fully tailored solutions for everyone.

We’re a Money Lender That Adopts a Customer-First Culture

Customer satisfaction is important to us. As a trusted money lender in Geylang, we’re committed to providing customers with the smoothest experience when borrowing from a licensed money lender.

Look What Our Happy Customers Have to Say About Their Favourite Geylang Money Lender

Our legal loan company provides a wide variety of loans in Singapore

Personal Loan

Wedding Loan

Debt Consolidation

Loan

Business Loan

Access flexible interest rates ranging from 2.88% to 3.92% a month

Enjoy a lightning-fast loan process, from start to end in ≤ 30 minutes

As a licensed money lender in Singapore, we don’t have any hidden fees and charges

Every money lender loan boasts a tailored repayment plan that suits your needs

Our legal loans have tenures of up to 12 months

Who Can Apply for Quick Money Lender Loans in Singapore?

- Singaporeans, Permanent Residents and Foreigners who are at least 21 years old

- These individuals must have consistent income stream(s)

- People borrowing from a licensed money lender because of a low credit score or bad credit history

- Folks who need monthly loans or bad credit loans from a legal money lender

4 Simple Steps to Get Your Monthly Loan From a Top Geylang Legal Money Lender

4 Simple Steps

to Get Your Monthly Loan From a Top Geylang Legal Money Lender

Apply for your money lender loan online with Singpass.

Our loan officer will contact you to schedule a face-to-face meeting.

Discuss your desired legal loan amount and repayment terms with the loan officer.

Review and sign the legal loan’s contract, and receive your funds via cash or PayNow.

FAQs

About Borrowing From a Licensed Money Lender

What is a licensed money lender in Singapore?

A legal and authorised money lender in Singapore carries out the business of moneylending under certain ministry regulations and laws. Even though legitimate money lenders work independently and are not tied to public financial institutions, all authorised money lenders in Singapore have to be registered with a licence number under the Registry of Moneylenders.

The registered money lenders are regulated by the Ministry of Law; they must also adhere to the laws and rules in the Moneylenders Act or risk losing their licence.

How old do I have to be to get a loan from a legal money lender in Singapore?

You need to be at least 21 years old in order to borrow from a licensed money lender. Apart from your age, we also consider other factors, including your employment status and credit rating. Get in touch with our friendly loan consultants at 6848 0033 for more information regarding your loan eligibility from a legal money lender in Singapore.

Are all authorised money lenders the same?

Not really. Every authorised money lender in Singapore has its own loan terms and conditions, interest rates, fees and charges, expertise, reputation, moneylending experience, etc.

Do licensed money lenders in Singapore have high loan approval rates?

In general, yes. It’s common to see licensed money lenders have loan approval rates as high as 90% or 99%!

Do legal money lenders offer personalised loan solutions?

Yes, many legal money lenders in Singapore pride themselves on offering personalised loan packages for borrowers.

Can I apply for a licensed money lender loan online?

Yes, you can conveniently apply for your loan online from a licensed money lender like Elite Investment & Credit. However, note that the licensed money lender loan process cannot be entirely online—you’ll be required to meet your money lender at their office for verification, loan contract review and contract signing before any funds can be disbursed. The overall process will not take long, so don’t worry!

Can I negotiate for flexible repayment terms with a licensed money lender?

Yes, you may discuss your needs with your authorised money lender of choice.

Is there any income requirement I must hit in order to borrow from a legal money lender?

No, legal money lenders do not impose any minimum income requirements. For the most part, you just need to be employed and be able to furnish them with proof of regular income.

Is there any minimum amount for a licensed money lender loan?

No, you are free to borrow a small sum of money if that’s what you need.

Do legal money lenders offer prompt customer service?

While we can’t vouch for all legal money lenders in Singapore, rest assured Elite Investment & Credit will provide assistance as soon as we can, no matter if you’re contacting us through WhatsApp, SMS, phone call, email or our online enquiry form.

Do licensed money lenders provide financial advice?

Respected licensed money lenders like Elite Investment & Credit are happy to provide borrowers with sound financial advice. We are committed to helping you navigate through your financial woes safely and manageably.

Is it possible to get my loan from a legal money lender approved if my credit rating is poor?

Yes, it is possible to get loan approval from a legal money lender even with a poor credit rating. As one of the top licensed money lenders in Singapore, we strive to do our best to assist our customers regardless of what financial situation they’re in. It is always our practice to customise legal loan packages with an amount and repayment schedule that best suits your needs.

Can I still get a loan if I can’t make it to your registered money lender office during business hours?

Our registered money lender office’s business hours are from 11.30am to 7.30pm on weekdays, and 11.30am to 7.00pm on Saturdays. If you aren’t able to visit our local money lender office during business hours, don’t hesitate to speak to us — we will try our best to accommodate your schedule.

What are the modes of payment available for my money lender loan?

You can repay your money lender loan via bank transfer, GIRO, or cash at our office. Please indicate your preferred mode of payment when your loan is approved.

Can I take up a legal loan from you even though I’m a discharged bankrupt?

Yes! We do not discriminate against anyone who’s borrowing from licensed money lenders — you can still take up a legal loan from us as long as you’ve been discharged from bankruptcy. Rest assured that we will perform an assessment prior to approving your loan.

How do I tell the difference between a licensed money lender and an illegitimate money lender in Singapore?

To avoid falling into scams, it’s important to differentiate between licensed money lenders and unauthorised private money lenders. Here’s how to tell the difference between licensed and illegal private money lenders in Singapore:

If the local money lender you are approaching is not on the list of authorised money lenders, they are likely illegal. You should always check the money lender’s licence number and enquire with the authorities if you have any doubts.

If you receive advertisements through unsolicited emails, SMS, calls, social media ads, and door-to-door flyers, the money lender is unauthorised and should be reported to the police.

Illegal money lenders usually push for full online transactions. If a local money lender promises quick loan payouts without meeting at a registered business address, be wary and report them to the authorities.

Legalised money lenders in Singapore have their own rules and regulations on debt collection, and they are strictly prohibited from harassing their borrowers with threats and violence.

To learn more about how to spot illegal money lenders, check out the top 9 signs of illegal money lenders in Singapore.

What is the difference between taking a loan from local money lenders and banks?

Local money lenders and banks have their pros and cons. Here’s a breakdown of the differences between banks and legalised, reliable money lenders in Singapore:

| Banks | Licensed Money Lenders | |

| Average interest rate | 3.38 - 5.42% per annum | 1 - 4% per month |

| Borrowing sum | Up to 10 times monthly income | Up to six times monthly income |

| Loan approval timeline | Typically a few days or more | Same day approval |

| Credit assessment | Requires a good credit score | Does not require a good credit score |

| Minimum income requirement (unsecured loan) | At least $20,000/year | No minimum income requirement |

| Repayment period (personal loan) | Up to seven years (most banks offer five years) | Up to 12 months |

What should I look out for when enquiring with private money lenders?

If you’ve decided to go ahead with an authorised money lender in Singapore, there are a few things you should look out for before diving in:

Interest rates and fees

When you’re shopping around, you definitely want to find quick money lenders with low interest rates. Don’t settle for the first online money lender in Singapore you approach as you can negotiate and reduce your fees if you search well enough.

Loan terms

When you receive your loan contract from the money lender, it’s extremely important to go through it thoroughly before signing to ensure you don’t experience any penalties and land yourself in bigger debt.

Reputation and reviews

If a money lender has disproportionately larger one and two-star reviews on Google, it’s best to stay away from them. Reliable money lenders in Singapore are usually licensed, flexible, and rated highly with many positive reviews.

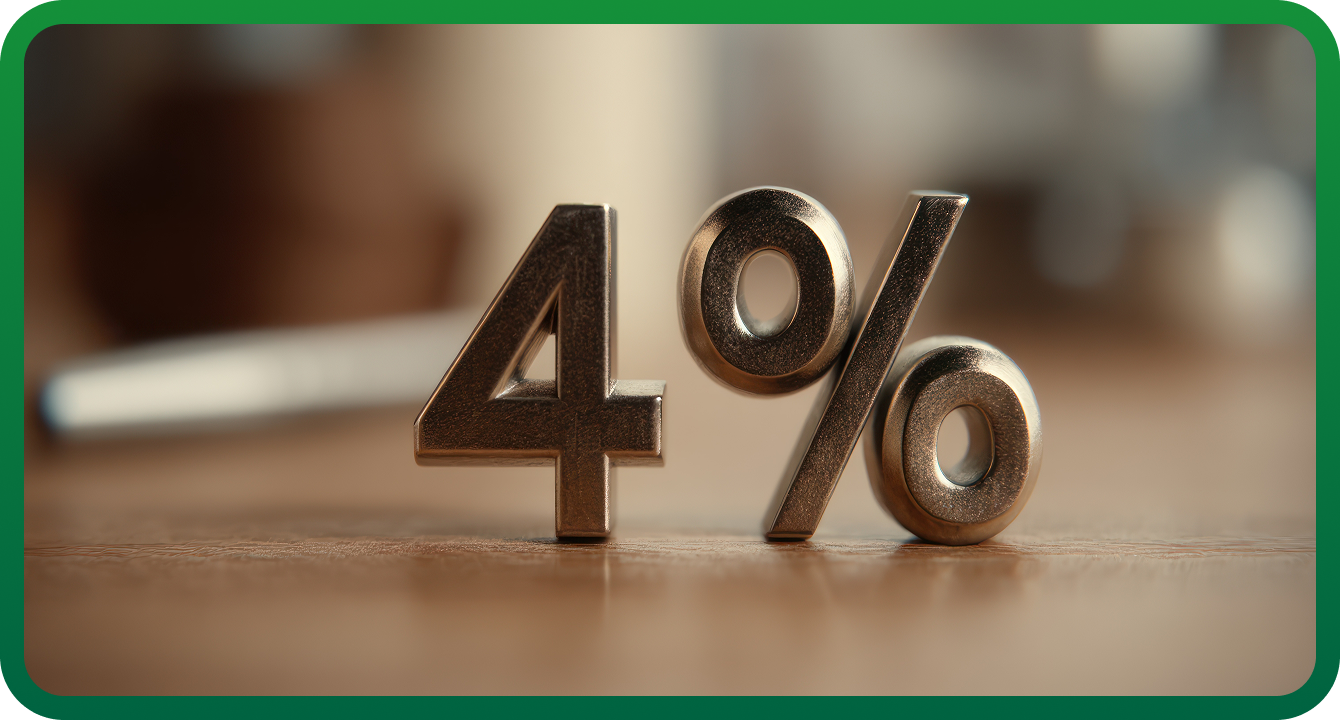

What are the interest rates, fees, and charges when borrowing from licensed money lenders?

When applying for a loan with licensed money lenders, it’s important to know the possible fees you could be charged:

| Maximum fees money lender can charge | |

| Chargeable Fees | Capped Amount |

| Interest rate | 4% each month |

| Late interest | 4% each month for every month of late repayment |

| Late repayment fee | $60 for every month of late repayment |

| Processing fee | 10% of the principal loan amount |

| Legal fee(for recovery of the loan if borrowers default) | Decided by court |

Interest rate

Most of the time, legal money lenders charge an interest rate between 1% and 4% monthly— you can use a loan charge calculator to get an accurate amount. The 4% monthly cap on interest rates is applicable regardless of the borrower’s income and loan type.

Late interest

Licensed money lenders in Singapore can also charge you late interest fees on top of your negotiated monthly interest rate if you don’t pay your instalments on time. Late interest rates are capped at 4%.

Late repayment fee

If you do not pay your loan on time, your money lender can also charge an additional fee for each late payment. This fee cannot exceed $60 for every month of late repayment.

Loan processing fee

Money lenders usually charge a processing or administrative fee when you apply for a loan. This processing fee cannot exceed 10% of the principal loan amount.

Important

Under the Moneylender’s Act, the total amount that legal money lenders can charge (including the monthly interest, late interest, late repayment fee, and administrative fee) cannot exceed the principal loan amount.

Do money lenders levy early repayment charges?

No, legal money lenders in Singapore do not bill borrowers with early repayment charges.

How can I improve my chances of a successful loan application with a licensed money lender in Singapore?

Having a favourable credit score can increase your chances of getting a loan approved when borrowing from licensed money lenders.

Licensed money lenders prefer borrowers with a stable income stream as this means they will likely be able to make their repayments on time. This income can come from full-time employment or part-time work, as well as other means, such as property rental, monthly CPF payouts, or spousal maintenance.

What scenarios might a legal money lender reject my loan application?

Borrowers have a loan limit across all money lenders in Singapore. If that limit is hit, they will not be approved for any more loans. Also, borrowers with multiple existing loans usually have a higher chance of defaulting. Therefore, money lenders will usually reject a borrower’s loan application if they have too many loans. To improve your chances of approval, learn how to avoid having your loan application rejected in Singapore.

What should I take note of when borrowing from licensed money lenders in Singapore?

Once you’ve received your loan from the licensed money lender, it’s important to take down your repayment dates and follow them religiously using a repayment schedule. To ensure you pay on time, budget your monthly expenses.

Additionally, before signing a contract, make sure you agree to all the terms stated by your legalised money lender in Singapore. Make sure to keep a copy of the contract as well. Otherwise, your loan could be considered fraudulent.

If you’re struggling to get your loan approved from a private money lender in Singapore, you can consider getting a guarantor for a higher chance of approval.

What are some loan repayment tips to pay off licensed money lender loans on time?

To pay off your loan from a money lender on time and diligently, here are some tips:

Try to pay off loans with the highest interest rates as early as possible. You can do this by increasing the payment amount but remember to strike a balance if you have other loans from money lenders to pay off.

Taking on loans from money lenders comes with the responsibility of being organised. Whenever you make a payment to your money lender, keep the transaction receipt as proof.

The best way to stay in control of repayment is to reduce any unnecessary expenses. By cutting down on luxury or unnecessary purchases, you can save on cash and put it towards your repayment amount.

What happens if you are unable to pay a money lender in Singapore?

If you are unable to pay your money lender, you can:

Negotiate repayment terms or opt for a refinancing plan

Most licensed, trusted money lenders in Singapore are willing to offer flexible terms for loan repayment, which may include negotiating an extension or refinancing the loan. If you opt for a refinancing plan, you can change the loan tenure or consider a debt consolidation loan to consolidate multiple loans with money lenders.

Approach social service agencies

For loan repayment advice when borrowing from licensed money lenders, social service agencies provide credit counselling and assistance for loan repayments to those who are struggling.

If you are not able to pay off your loan, approach any of these agencies for financial aid and assistance: Credit Counselling Singapore, Arise2Care Community Services, Blessed Grace Social Services, One Hope Centre, Adullam Life Counselling, Silver Lining Community Services, Association of Muslim Professionals (AMP).

Apply for the Debt Repayment Scheme

If you have exhausted all your options and are planning to file for bankruptcy, look into the Debt Repayment Scheme (DRS). The DRS lets you repay your loans as all your ongoing interest charges will be frozen and your money lender will not be able to file for litigation against you.

For more information, please refer to our guide on how to settle licensed money lender debt.

Are licensed money lenders allowed to harass borrowers?

While legitimate licensed money lenders have the authority to retrieve your loan through legal means, they are also regulated under strict laws. This forbids them from resorting to harassment tactics.

Here’s a quick look at what’s accepted and not accepted as reasonable behaviours.

| What licensed money lenders CAN do | What licensed money lenders CAN’T do |

| Send a Letter of Demand to the borrower’s place of residence or employment in an enclosed envelope | Openly display a Letter of Demand at the borrower’s residence or on social media |

| Send text messages and make phone calls to the borrower within specific hours

Mon-Fri: 8am – 10pm Sat & Sun: 9am – 9pm |

Harassing the borrower with calls during unusual hours at the expense of their family and colleagues, or making anonymous calls to contact the borrower |

| Hire assigned debt collectors to retrieve loans through legal means | Stalking and pestering the borrower at their place of residence or employment |

| File for litigation against you | Using threatening language and aggression towards the borrower |

How to deal with licensed money lender harassment in Singapore?

If your money lender is pressuring you with threats and aggression, you can take action by making a police report and/or filing a complaint to the Ministry of Law, Credit Association of Singapore, or social service agencies. Our guide on how to stop licensed money lender harassment offers further guidance on dealing with such issues.