Some loans pose increased default risk for lenders, and as a result, require a guarantor. For instance, guarantors may be needed for foreigners taking a car loan, for younger borrowers taking an education loan, and for business loans, in place of collateral. Licensed moneylenders, too, may require a guarantor, but before you sign up as one, be sure to familiarise yourself with loan guarantor requirements in Singapore.

What is a loan guarantor?

A loan guarantor is an individual who promises to be responsible for someone else’s debt repayment, should the latter fail to make good on their debt obligations.

In other words, if a borrower is unable to pay the money lender, both they and the loan guarantor are on the hook for the outstanding debt.

Loan guarantor requirements in Singapore

To be a loan guarantor, there are certain eligibility criteria to be fulfilled. Generally, loan guarantors must be:

- Singapore citizen or Permanent Resident

- Age 21 and above

- Not an undischarged bankrupt or undergoing bankruptcy proceedings

In addition to the above, some lenders may also require a loan guarantor to fulfil additional criteria such as income level and credit history. These eligibility conditions should be discussed in detail with the lender.

Responsibilities and obligations of a loan guarantor

Let’s say your brother needs an education loan. He is under 21 years old, and hence, requires a guarantor. You agree to be the guarantor of the loan and co-sign the loan contract in this capacity.

As long as your brother faithfully makes repayments to his education loan, you will not be impacted in any negative way. However, if he fails to repay the loan, even partially, you will be asked to bear the debt on his behalf.

Your responsibility as the loan guarantor lasts until the debt is properly discharged, either through full repayment or when the loan is written off.

Beyond the loan, the loan guarantor is also liable for all legal fees, costs, and accumulated interest incurred over the entire default payment period.

Legal obligations of a loan guarantor in Singapore

Be aware that as a loan guarantor, you will have to bear specific legal obligations, as follows:

- Principal debtor clauses – If a principal debtor clause is included, you will be liable as if you had borrowed the money yourself. This means that even though the borrower may escape liability, you would remain liable.

- Payment on demand – The lender can seek repayment from you without having to prove it has attempted to recover the debt from the borrower.

- Restructuring – Your obligations as guarantor persist even if the lender restructures the loan.

- Continuing security – Besides the borrower’s outstanding debt, future advances to the borrower and resulting lender’s charges and costs, are also included under your legal obligations.

- Subordination – You can only take recovery action against the borrower after the lender has settled up the borrower’s debt. You also cannot take security or collateral from the borrower that may prejudice the rights of the lender.

- Concurrent remedies – You may be subject to debt recovery at the same time as the borrower.

- Set off – If you have any money held by the lender, it may be deducted to offset the outstanding loan.

Things to note when becoming a loan guarantor

Being a loan guarantor is not something to be taken lightly. There are severe consequences that can arise should the borrower fail to repay the loan.

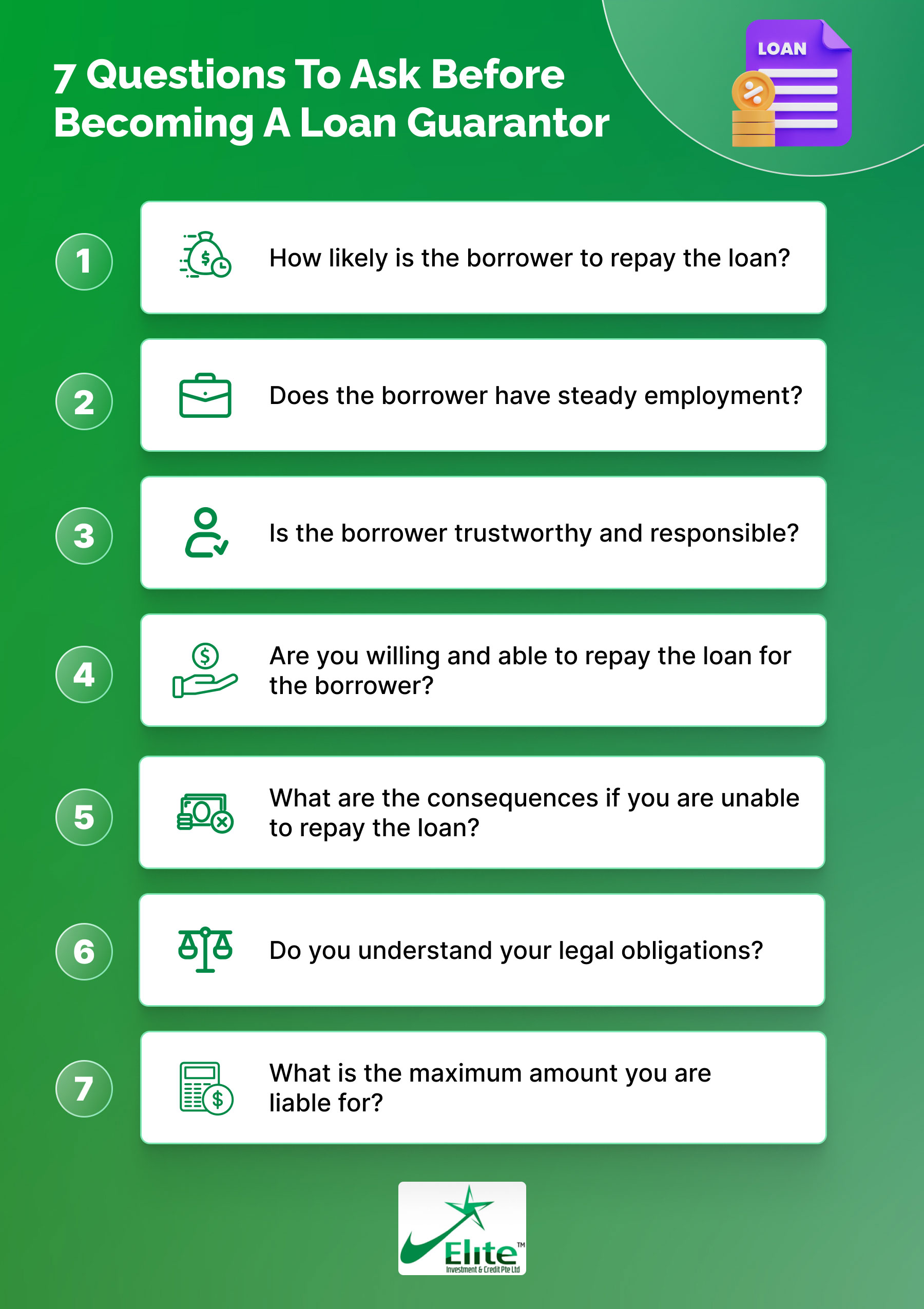

Before becoming a loan guarantor, you should take note of the following.

Are you able to repay the loan on the borrower’s behalf?

If the borrower defaults on the loan, the debt obligation will fall upon you. If that happens, are you willing and able to repay the loan on the borrower’s behalf?

Note that you will also be liable for legal fees, accumulated interest, and other costs that may arise from the default.

How likely is the borrower to repay the loan?

If you are being asked to stand as a loan guarantor, you should evaluate carefully if the borrower can repay the loan.

Don’t just take their word for it. Watch out for warning signs such as inability to keep up with bills or hold down a steady job, reckless spending, a tendency to lie or break promises, and other untrustworthy behaviour.

Remember, you are not obliged to be anyone’s loan guarantor. If you are unsure that the borrower will make the loan repayments faithfully, you should not agree to guarantee the loan.

Do you fully understand your obligations?

Make sure to fully read and understand the terms and conditions of the loan, your obligations as the guarantor, and the conditions under which your obligations will be called in.

Take your time and read everything carefully. If there is anything you do not understand, ask the lender to explain it to you.

Has a copy of the Note of Contract been given to you?

The lender should provide you with an official copy of the Note of Contract, clearly spelling out loan details such as:

- Loan amount

- Loan interest rate

- Loan tenure

- Maximum amount payable

- Admin fee

- Late fee

- Late payment interest

You should keep your copy of the loan contract securely until the debt has been paid off and your obligations as a loan guarantor are discharged.

Conclusion: Proceed carefully if asked to be a loan guarantor

As discussed in this article, loan guarantor requirements in Singapore are not very complex or strict. Anyone who is an adult and holds Singapore citizenship or Permanent Resident status, and in good credit standing can sign up as a loan guarantor.

However, the responsibilities and legal obligations that come with such a role are serious, and being a loan guarantor is not to be taken lightly. Be sure to consider any such requests carefully and thoroughly.

Elite Investment & Credit is a leading provider of flexible loans with low interest and generous repayment terms. Contact our friendly team to discuss your financial needs today!

About the Author

Jasbir Kaur

No fuss, No stress. You can count on me to get the facts right.