Key Takeaways

- Be cautious of unsolicited offers — Legitimate lenders will never approach borrowers via WhatsApp, SMS, or social media. If you receive an unsolicited loan offer, it’s probably a scam.

- Never pay upfront fees — Licensed money lenders do not ask borrowers to pay “admin” or “processing” fees before a loan is disbursed. Fees, if any, will be deducted from the principal loan amount at disbursement and must be clearly stated in the contract.

- Safeguard your personal info — Details like your NRIC, Singpass login, bank information, and OTPs are highly sensitive. Never share them and keep them secure at all times.

- Verify before you borrow — Always cross-check with the Ministry of Law’s Registry of Licensed Moneylenders before committing to a loan and only use official, verified channels.

- Act quickly if you’ve been scammed — stop contact immediately, lodge a report via ScamShield or to the Police, and seek help. Prompt action can save you from further losses.

Loan scams in Singapore have become increasingly common, especially as more people turn to online searches and social media for quick financial help. According to advisories from the Singapore Police Force (SPF), many Singapore loan scam incidents begin with unsolicited messages and fake loan offers from scammers impersonating licensed money lenders, resulting in significant financial losses for victims.

What makes loan scams in Singapore particularly dangerous is how convincing they can be. Scammers often pose as legitimate licensed money lenders, promise fast or “guaranteed” approvals, and prey on borrowers who may already be under immense financial pressure. This is why awareness is crucial — before applying for any loan, understand how loan scams in Singapore operate and recognise loan scam red flags to avoid making costly mistakes.

What Are Loan Scams?

Loan scams are fraudulent schemes in which scammers pose as legitimate lenders to trick victims into handing over money, personal information, or both. Unlike licensed money lenders in Singapore, who are governed by the regulations set out in the Moneylenders Act, scammers are not bound by any legal and ethical standards.

These Singapore loan scam schemes are carefully designed to appear credible but ultimately aim to exploit borrowers — especially those in urgent need of financial assistance.

Common loan scam tactics include:

- Advertising “fast cash” loans through short videos or sponsored ads on platforms like TikTok and Facebook

- Sending unsolicited loan offers via SMS or WhatsApp

- Demanding upfront “processing” or “administration” fees before any loan is disbursed

- Inventing vague charges like “account clearance”, “insurance fees”, or “lawyer fees” to justify money transfers

- Requesting sensitive personal information such as NRIC details, bank account numbers, or Singpass credentials

- Harassing or threatening victims to force repayment for loans that were never issued

- Impersonating real licensed lenders by copying company websites, names, logos, or license details

- Trapping victims in repeated requests for additional “fees” while no loan is ever released

To entice victims, scammers often promise unrealistic loan terms — such as guaranteed approval, no credit checks, or instant cash with zero documentation. If an offer sounds too good to be true, it almost certainly is.

How Loan Scams Operate in Singapore

#1 Messaging & Social Media Loan Scams

One of the most common forms of loan scams in Singapore starts with unsolicited messages sent through channels like SMS, WhatsApp, Telegram, TikTok, or Facebook. Victims are often contacted out of the blue and told they are “pre-approved” for a loan, usually paired with attractive promises of low interest rates and same-day disbursement.

Once communication begins, scammers typically request upfront payments framed under the guise of “admin fees”, “lawyer fees”, or “insurance deposits” before the loan can be released. After the first transfer is made, victims may be pressured to pay additional fees — or the scammer may vanish entirely, leaving them with no loan and little chance of recovering their money.

#2 Impersonation of Licensed Entities

Another prevalent Singapore loan scam tactic involves impersonating licensed money lenders, banks, or even government agencies. Scammers may use real company names, copied websites, or fake licence numbers to make their offers appear legitimate and trustworthy.

It’s important to remember that licensed lenders in Singapore will never initiate contact with you through social media, SMS, or unsolicited messages. If you receive a loan offer you didn’t apply for, it is a major red flag — do not engage with it.

#3 Requests for Sensitive Personal Information

Many scammers also attempt to collect sensitive personal details, such as NRIC photos, Singpass login credentials, bank account numbers, or One-Time Passwords (OTPs). These requests often come with reassurances that the information is necessary for “verification” or “processing.”

Legitimate lenders will never ask for Singpass credentials or OTPs over messaging apps. Once such information is compromised, victims may face unauthorised transactions, identity theft, and the need to file a loan scam complaint with the authorities.

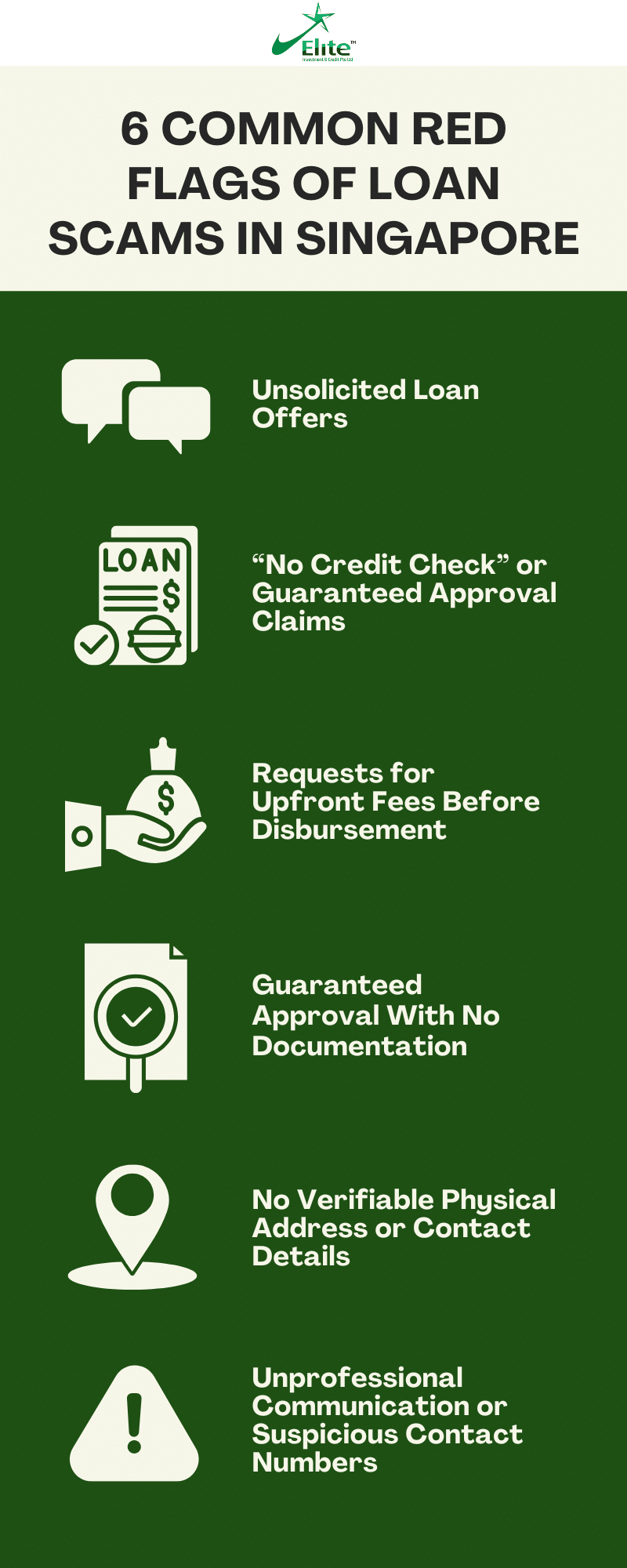

6 Common Red Flags of Loan Scams in Singapore

- Unsolicited Loan OffersReceiving a loan offer you didn’t apply for is one of the clearest warning signs of a loan scam. In Singapore, legitimate, licensed money lenders do not cold-message borrowers through WhatsApp, SMS, or social media.

- “No Credit Check” or Guaranteed Approval ClaimsPromises of “no credit check required” or “guaranteed approval” may sound appealing, but they are unrealistic. These claims are commonly used by operators of loan scams in Singapore to target borrowers in desperate need of funds.

- Requests for Upfront Fees Before DisbursementAny demand for processing, administrative, or “security” fees before a loan is released is a classic loan scam tactic. Licensed lenders deduct approved fees from the loan principal only after it has been granted.

- Guaranteed Approval With No DocumentationLegitimate lenders are legally obliged to verify borrowers’ income, employment, and supporting documents before granting a loan. If a lender claims no checks are needed, it usually means no real loan.

- No Verifiable Physical Address or Contact DetailsIf a lender can’t provide a verifiable office address and communicates only via mobile or messaging apps, it’s likely a loan scam. Licensed money lenders in Singapore must have a traceable, registered business location.

- Unprofessional Communication or Suspicious Contact NumbersLoan scam operators often reveal themselves through poor grammar or unprofessional messaging, aggressive pressure tactics designed to make victims act quickly, and frequently changing phone numbers to stay untraceable.

If you spot any of these warning signs, it’s a clear signal to disengage immediately and consider filing a loan scam complaint.

Legal Requirements vs Loan Scam Practices

Under Singapore law, licensed money lenders must follow strict regulations designed to protect borrowers:

- They cannot advertise or solicit loans through messaging apps, social media, or unsolicited phone calls.

- They are required to meet borrowers in person at their registered business address.

- They cannot collect upfront fees before a loan is officially approved and disbursed, in line with the Registry or Moneylenders’ guidelines.

Scammers, on the other hand, operate in the exact opposite way. They reach out online, pressure victims into paying “processing” or “admin” fees upfront, and avoid face-to-face interactions altogether.

By understanding these clear differences between licensed money lenders in Singapore and loan scammers, borrowers can quickly spot red flags, avoid costly mistakes, and protect themselves from falling victim to loan scams.

How to Protect Yourself From Loan Scams

- Verify Lenders Before Applying: Always check the Registry of Moneylenders and verify the lender’s licence before applying for a loan. This is the most reliable way to ensure a lender is legitimate and avoid falling victim to loan scams in Singapore.

- Use Official Channels Only: Only deal with lenders through verified websites, official landline numbers, or physical offices. Be cautious of lenders who operate solely through messaging apps — they are likely loan scams in disguise.

- Never Share Sensitive Information: Keep your Singpass login, banking passwords, and OTPs private. Sharing them — even with someone claiming to be a lender — can lead to financial loss and identity theft.

- Report Suspicious Activity: If you receive scam messages or suspicious calls, report them immediately by lodging a police report or submitting information via the I-Witness platform. Call 999 if you’re in immediate danger. Acting promptly helps protect both yourself and others from falling victim to loan scams.

- Educate Family & Friends: Talk to your loved ones about common loan scam tactics, especially elderly family members who may be more vulnerable. Knowledge is one of the best forms of protection against unwarranted, illegal money lender debts.

What to Do if You Think You’ve Been Scammed?

If you suspect you are dealing with a loan scam, take these steps immediately:

- Stop all communication with the scammer.

- If your account or credit card has been compromised, contact your bank right away. You may also call the ScamShield helpline at 1799 to get directed to your bank.

- Report the incident to the authorities. File a police report online or in person at your nearest Neighbourhood Police Post, or call 999 for urgent assistance.

- Seek professional help if you’re in need of emotional or financial support. Counselling services and community support programmes are available to assist you during this challenging time.

Conclusion: When in Doubt, Don’t Proceed

When it comes to loan scams in Singapore, knowledge is your strongest defence. Scammers rely on urgency, confusion, and misleading information — borrowers who stay informed and cautious are far less likely to become victims.

Always borrow responsibly: verify the lenders, stick to licensed lenders or banks, and ensure the loan complies fully with Singapore’s laws before proceeding. Planning ahead? Use our free personal loan calculator to see exactly how much you can borrow and make smarter, safer decisions.

When in doubt, pause, verify, and walk away. Being cautious today could save you from becoming the next victim of a Singapore loan scam.

Looking for a safe and trusted lender? Elite Investment & Credit is a reputable licensed lender you can rely on. Apply now or speak to our friendly team to explore your options. We are always ready to listen and advise.