The loan tenure governs the duration of your loan. But beyond that, loan tenure can also affect your loan in various ways that may not be immediately obvious. Here is an in-depth explanation regarding loan tenure meaning, what may affect the loan tenure offered to you, and how you can choose the most suitable one.

Loan tenure meaning – explained

What is loan tenure? Simply put, the loan tenure is the length of time during which a loan is repaid through regular, fixed instalments. Each monthly instalment consists of partial repayment of the principal amount, as well as interest charges. Using a loan charge calculator is helpful when estimating how much the instalments would be for a given loan tenure.

At the end of the loan tenure, the last instalment becomes due. Provided the loan is fully paid up by then, and there are no fees or charges left outstanding, the loan then ends and the borrower’s obligation is discharged.

Loan tenures are available in a wide selection, ranging from as short as a few months, to several years or even decades. This depends on the type and nature of the loan.

For instance, short-term loans and balance transfers have a loan tenure of a few months, whereas home mortgages can range from 10 to 30 years.

Sitting somewhere in the middle are personal loans, which can have tenures of between 12 months to five years. Meanwhile, car loans can be repaid over up to 7 years at maximum.

READ MORE: How to acquire a loan even with bad credit history

How loan tenure affects borrowers

We’ve only just scratched the surface with the loan tenure meaning laid out above. It is important to understand the relationship between loan tenure, instalment amount, and cost of borrowing before taking a loan.

A longer loan tenure offers lower monthly instalments, but a higher total interest paid. The reverse is also true; a shorter loan tenure means a higher monthly instalment, but a lower total interest paid.

Have a look at the following example:

| S$2,000 loan at 4% per month | 6-month loan tenure | 12-month loan tenure |

| Total interest | S$289 | S$557 |

| Monthly repayment | S$382 | S$213 |

Here, we see that a 6-month loan tenure for a S$2,000 loan at 4% interest per month results in a total interest of S$289. The amount to be paid each month is S$382, for six months.

On the other hand, a 12-month loan tenure will incur interest of S$557 in total. However, each monthly payment is lower, at S$213, but you’ll be making repayments for 12 months.

So what is the implication of loan tenure for borrowers? Well, borrowers will need to balance between the duration of being in debt, the amount to pay each month, and the interest paid on the loan (cost of borrowing).

While there is nothing wrong with being in debt (as long as it is managed responsibly), the loan repayments represent a financial commitment, which some may prefer not to shoulder.

While paying back a loan as quickly as possible is preferable, this is limited by how much you can pay each month. Loan repayments that are too high for you to cope with will create stress and cause you to incur extra interest charges on missed instalments.

And lastly, a higher cost of borrowing is disadvantageous compared to a lower cost of borrowing – borrowers should aim to pay less interest, not more.

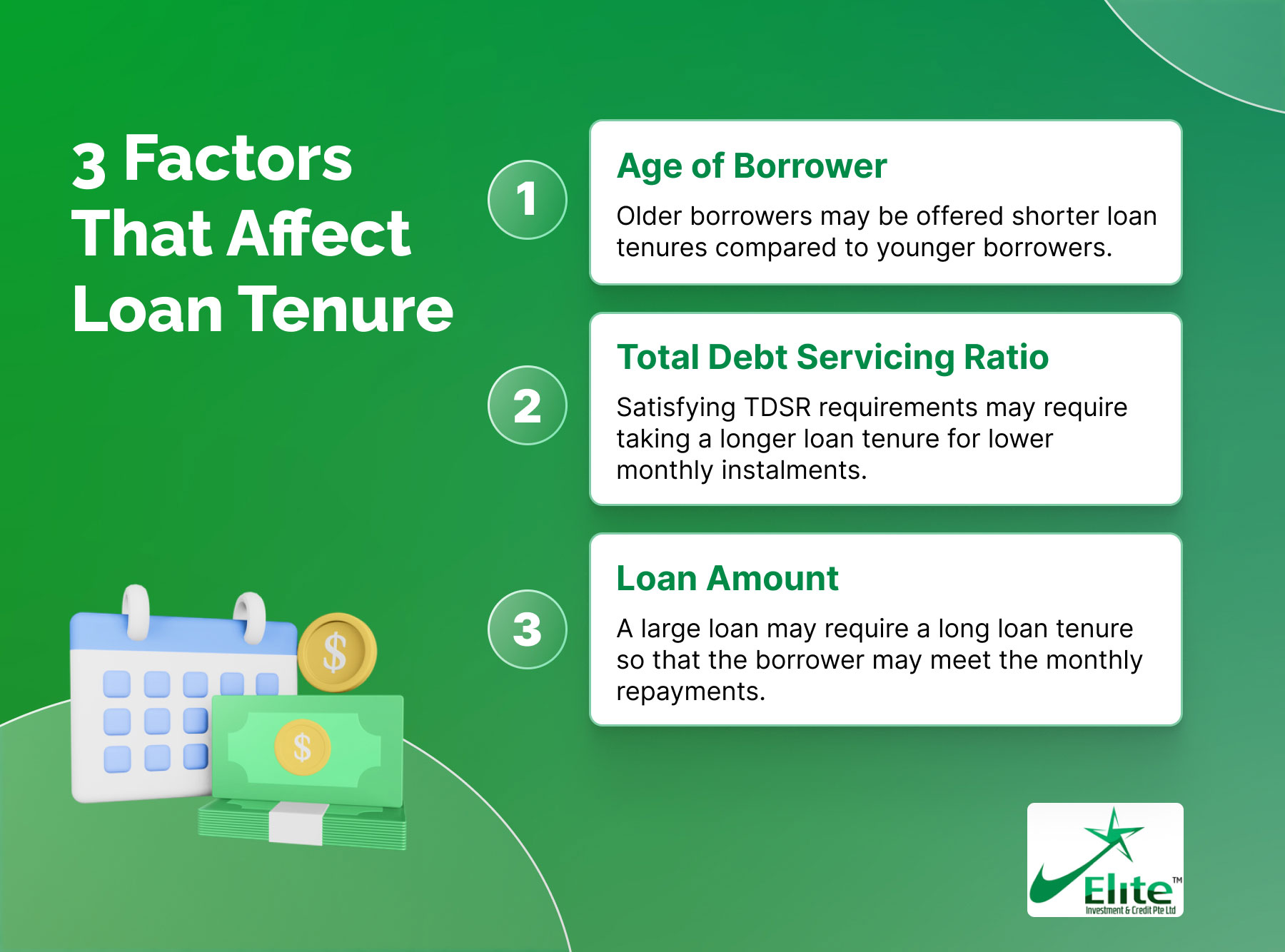

Factors that determine loan tenure

There are several factors that a legal money lender in Singapore takes into consideration when determining the loan tenure offered on a loan.

Age of the borrower

Logically, borrowers rely on their income to repay their loans. Someone who is retired and no longer has an income may find difficulty in meeting the instalment payments.

Therefore, those who are nearing retirement will likely face restrictions on their loan tenure – they will be unable to choose a loan tenure that exceeds retirement age, to reduce the risk of loan defaults.

This limitation is most prominent in a home mortgage. As home mortgages are typically several decades long, older borrowers are likely unable to be granted the maximum loan tenure, whereas their younger counterparts may be.

Total Debt Servicing Ratio (TDSR)

For borrowers in Singapore looking to apply for a home mortgage, the total amount of debt repayment each month cannot exceed 55% of their gross monthly income.

This is counted across all sources of debt, including unsecured debt like credit cards, bank loans, car loans, and home mortgages, and is known as the Total Debt Servicing Ratio (TDSR).

Therefore, if the home mortgage you are applying for would exceed the TDSR, you will have to apply for a longer mortgage tenure–which reduces the monthly repayment amount–to fulfil the requirement.

Loan amount

Particularly large loans, such as home mortgages, have long loan tenures of up to 30 years. The reason for such a long tenure is to make the monthly repayment affordable, and this illustrates how loan amounts can affect loan tenure.

If you are taking a large loan on a short loan tenure, the monthly repayment amounts may be too high for your budget.

If that’s the case, you’ll need to choose a longer loan tenure (or borrow a smaller amount) to bring down your instalments to a more suitable level.

Conclusion

To fully understand loan tenure meaning, we must be aware of the intertwining relationship between loan duration, instalment amount and total interest paid. This will allow you to make a better-informed choice when choosing a loan package.

Elite Investment & Credit is a fully licensed moneylender offering flexible loan packages with low interest. Contact us today to find out how our loan tenures can be catered to your needs.

About the Author

Jasbir Kaur

No fuss, No stress. You can count on me to get the facts right.