Introduced in 2008, the Moneylenders Act Singapore serves to protect the legitimate rights of borrowers and legal loan providers in Singapore. It accomplishes this through a legal framework that clearly defines permitted business activities, borrowing limits, and avenues for recourse.

In this article, we explain the Moneylenders Act in simple terms and highlight how it impacts borrowers seeking loans from licensed lenders.

Who is allowed to conduct moneylending in Singapore?

One of the most important functions of the Moneylenders Act Singapore is to define the parties allowed to conduct moneylending activities in the country.

According to the Moneylenders Act, entities who wish to legally lend money must belong to one of the following groups:

- Exempt money lenders: those who have been granted an exemption from holding a licence

- Excluded money lenders: those who are authorised to lend money under another law (e.g. pawnbrokers under the Pawnbrokers Act, credit societies under the Co‑operative Societies Act, etc)

- Licensed lenders: those who have been granted a licence by the Registrar under the Moneylenders Act Singapore

In this article, we will be focusing on the third group — licensed lenders in Singapore.

What the Moneylenders Act Singapore means for borrowers

You can borrow from legal loan providers

With the establishment of the Moneylenders Act, borrowers can seek loans from licensed lenders that are regulated by the authorities.

This offers a safe and legal alternative for people who may not qualify for bank loans, helping them to stay away from illegal lenders who are known to engage in predatory loan shark harassment tactics.

You can check if you are dealing with a licensed lender

The Ministry of Law maintains a list of authorised businesses that have been granted a licence to operate as lawful moneylending entities. This creates an additional layer of assurance for borrowers, as they can easily verify if the lender they are dealing with is a regulated entity before signing up for a loan.

You can view the list of licensed lenders in Singapore over at the Ministry of Law’s website.

Notwithstanding their licensed status, be wary if a money lender:

- Appears to be verbally abusive and behaves menacingly towards you.

- Demands for your personal Singpass info, i.e. username and password.

- Refuses to return your personal ID documents (e.g. NRIC card, work permit, driver’s licence, employment pass, passport, or ATM card).

- Insists on having you sign on an incomplete/blank loan contract.

- Provides you a loan offer without offering a copy of the Note of Contract for the loan and not giving a detailed explanation of the terms and conditions clearly.

- Agrees to extend a loan to you without adhering to rules and regulations (e.g. providing loan approval via illicit platforms (i.e. text messages, email, or phone call) before they’ve even received your application form and supporting documents (e.g. payslips, bank statements, and income tax assessment).

- Withholds any fraction of your principal loan sum for all kinds of reasons.

You are prevented from taking on too much debt

One of the purposes of the Moneylenders Act is to help ensure that borrowers are able to manage their debt obligations.

To that end, the Moneylenders Act spells out specific loan limits regarding the amount you can borrow from a licensed lender.

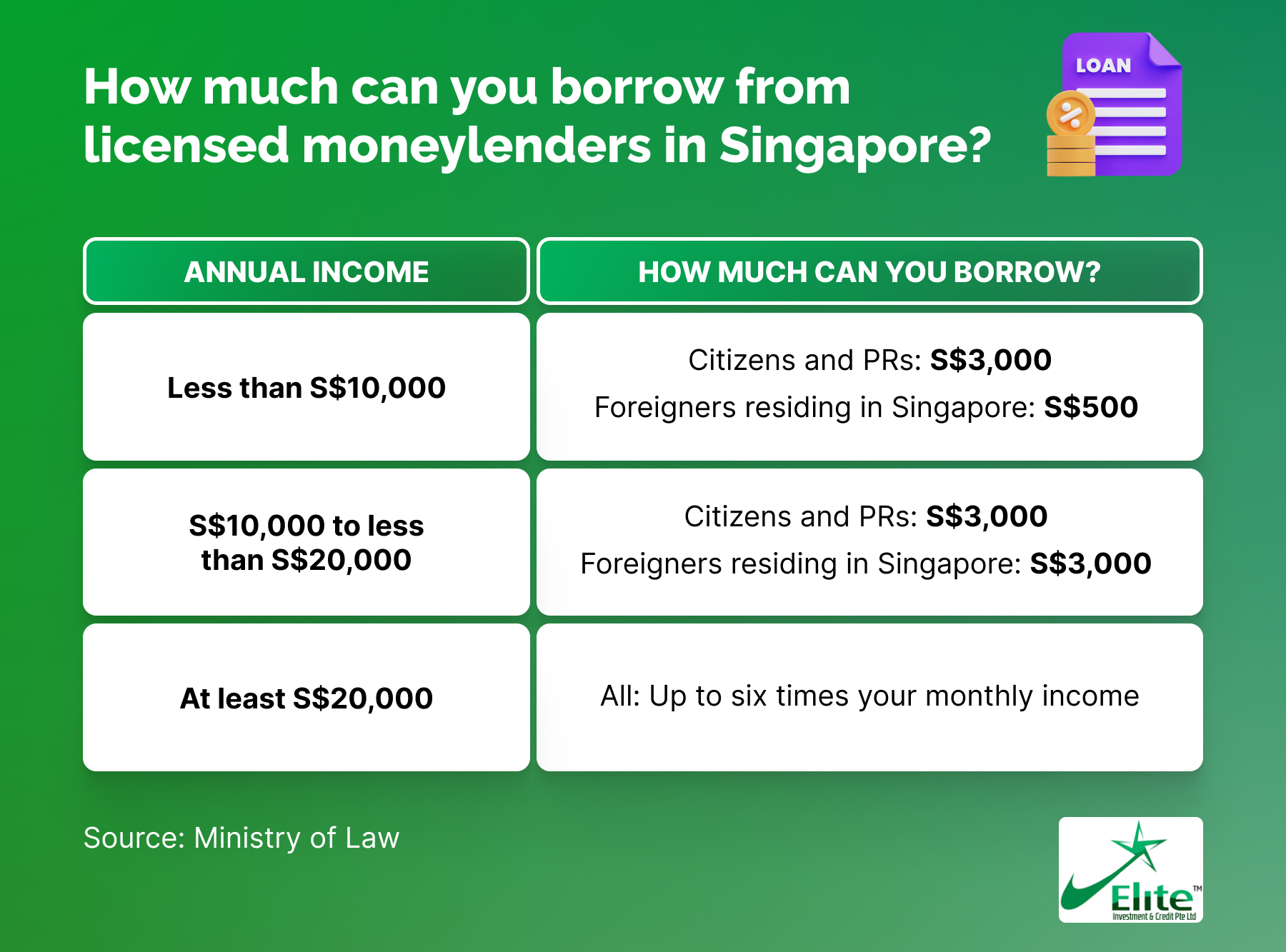

Your borrowing limits are pegged to your income level, as shown in the table below. Note that these are the total maximum amount that you may borrow at any time across all money lenders in Singapore.

Money lenders cannot overcharge you in fees and interest

According to the Moneylenders Act, licensed lenders are also prevented from overcharging their customers by imposing high fees and interest charges, helping to ensure that borrowers do not inadvertently fall prey to predatory or unfair tactics. This also applies to situations where borrowers are unable to pay money lenders.

Here’s how much licensed lenders are allowed to charge for their services.

- Loan interest rate: Up to 4% monthly, charged on the remaining loan principal

- Late interest: Up to 4% monthly on the amount due, for every month of late payment

- Late payment fee: Up to S$60 for every month of late repayment

- Admin fee: Up to 10% of the loan principal at the point when the loan is granted

Note that in total, the late fees, admin fees, interest, and late interest charged by the money lender cannot exceed your loan’s principal amount.

For example, if your loan amount is S$5,000, the interest, late interest, up to 10% admin fee, and up to S$60 late fee incurred for each month of late repayment cannot exceed S$5,000 in all.

Registered loan providers are also allowed to recover legal costs in the event of a successful claim for the recovery of a loan.

Other than these, money lenders are not allowed to impose any other fees or charges.

If you have been overcharged by a licensed lender in Singapore, or have been subject to other illegal or unfair practices, you may seek assistance by calling 1800 2255 529.

You should ignore loan offers coming through SMSes, calls, or flyers

Under the Moneylenders Act Singapore, lenders are limited in the channels they can utilise to advertise their services.

Specifically, they can only advertise through:

- business or consumer directories (both print or online)

- their website(s)

- advertisements at their business premises

As such, offers for loans from flyers, SMSes, emails, phone calls, messaging apps, or even social media platforms, are highly likely to be from unlicensed money lenders, even if they try to pass themselves off as having the proper licences.

Therefore, you should ignore unsolicited moneylending advertisements coming from these channels. Better yet, report them by calling 1800 2255 529, or using the Ministry of Law’s feedback form.

Conclusion: Moneylenders Act Singapore protects you

The authorities have implemented a robust legal framework to protect borrowers like you and I, so be sure to approach only licensed lenders for your financial needs if you need loans from alternative but lawful loan providers.

Elite Investment and Credit is an established, fully licensed loan company in Singapore with years of experience providing fair and reasonable loans to borrowers from all walks of life. We are committed to serving your financial needs with integrity and professionalism at all times. Reach out to learn more about our low-interest loans today!

About the Author

Jasbir Kaur

No fuss, No stress. You can count on me to get the facts right.